Master the Skills You Need to

Trade Full Time!

Download this Workbook and Learn How To Trade Like A

Full Time Trader With Andrew Keene.

What Makes Us Different?

Our investing strategies are unlike any other company or Hedge Fund Manager

Track Record

With over 4 decades of collective options exchange trading floor experience, our options trading plans have withstood the test of time and are compatible with any market environment.

Real Capital

We trade all of our options strategies using our own capital in REAL accounts shown in real time to ALL paid subscribers, NOT simulated or 'paper' accounts.

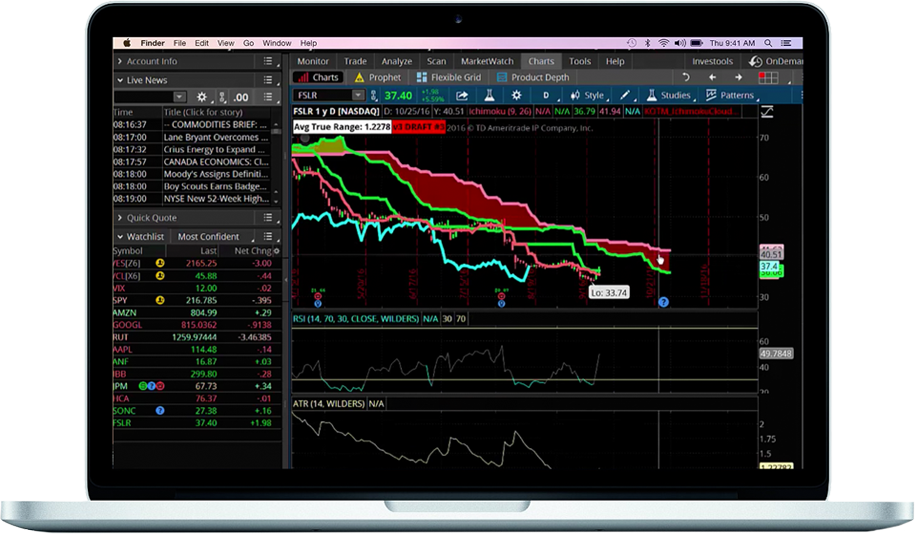

Superior Technology

With our Unusual Options Activity scanner, we watch over 500 trades each day from every options exchange. This allows in-depth, real-time order flow analysis with insight into the biggest institutional bets in the marketplace.

Free eBook! Learn How to

Trade Like A Full Time Trader

In the eBook, Keene breaks down the history of

Institutional Order Flow in the Options Market.

Want to read? Enter your name and email below!

No thanks, I don’t want the Successful Investing Guide