Learn How To Trade Like Us

Featuring Our Exclusive Trading Products

-

$399/moOptions Trading Room

90 minutes of full audio and video streaming from Andrew Keene in a community of hundreds of active traders.

Intraday Text of All SwingTrades.

Exclusive Pricing and Members Only Webinars.

Live with open chat: Active Community of Full-Time Traders.

CamarillaShark Indicator

$2999 /Indicator (One Time Purchase, NOT A SUBSCRIPTION)

CamarillaShark is our unique evolutionary step forward for a 20 year old mean reversion strategy long kept secret by bond traders.

The strategy uses adaptive fuzzy logic to determine by 9:40 whether the user should enter a trade long or short.

Then, instead of fretting over each tick, CamarillaShark owners have the luxury of true fire and forget trading; every day at 3:55 the day’s one and only trade per chosen symbol chosen symbol is to be closed.

Seriously. That’s it.

The bottom line is Bryan Klindworth, as a analysis system developer with a degree in economics, feels the only real solution to living in the “Upside Down” is to be as un-involved in the market psychologically as possible. And most importantly the strategy works.

Market Tide Indicator

$999 $399 /Indicator (One Time Purchase, NOT A SUBSCRIPTION)

Alphashark’s Market Tide Indicator is designed to work across equities or futures. It is designed to allow a trader to capture as much of their desired price movement as possible. It works on day trades, swing trades, scalps and position trades.

The basic concept is simple: to let the trader know whether the bulls or bears have control of price and provide entry signals when the market tide has shifted enough to warrant an entry; the Market Tide indicator is then designed to provide an exit signal when the market “tide” has weakened enough that it is no longer worth the risk of being in the trade, even if it isn’t initially.

Alphashark’s Market Tide Indicator has several exceptional features:

Provides entry and exit signals with as minimal price movement as possible, maximizing the price movement a trader can capture when potentially profitable and provides simple early signals when the market reverses.

Provides entry and exit signals with as minimal price movement as possible, maximizing the price movement a trader can capture when potentially profitable and provides simple early signals when the market reverses. Can help teach core concepts in trading.

Can help teach core concepts in trading. Works FANTASTIC as a confirmation indicator when used in conjunction with other indicators.

Works FANTASTIC as a confirmation indicator when used in conjunction with other indicators. Most importantly, it has parameters to allow the trader to set how big of swings in price they’d like to participate in before being given signals, allowing the indicator to be tailored to a particular trader’s tolerance for risk!

Most importantly, it has parameters to allow the trader to set how big of swings in price they’d like to participate in before being given signals, allowing the indicator to be tailored to a particular trader’s tolerance for risk!

Volume Shark Indicator

$2,999 /Indicator (One Time Purchase, NOT A SUBSCRIPTION)

Lance Ippolito’s Volume Shark is the first indicator of its kind for breakout trades.

Using three studies combined in one indicator available on Think or Swim and TradeStation, the Volume Shark can be used for day trading and swing trading on any time frame.

The studies are 100% customization to the user settings to perfect the individual traders needs! Entries are provided clearly via arrows on the charts with target and stop prices are displayed on the chart as well.

Traders can also see volume demand via colorful dots to confirm breakouts.

The Average True Range Formula is custom to the traders time frame calculated prior days movement along with trend direction to price targets effectively.

Finding Top Secret Statagies

$999 $499 /Workshop (One Time Purchase. NOT A SUBSCRIPTION)

The cryptocurrency space has been exploded in recent years. Anyone with 100 dollars can see their portfolio grow.

The question is, can you outperform the market by 5x, 10x, or 20x?

In this 4 hour special, Mr. S walks through his strategy for the beginning of 2018, his own personal portfolio for Q1 and how to pick the next batch of winners.

By focusing on the large market cap coins that will be effected by the upcoming surge of institutional money and investors, Mr. S believes the Cryptoshark community can benefit tremendously.

AlphaShark BBand Oscillator Suite

$2999$999 /Indicator(One Time Purchase. NOT A SUBSCRIPTION)

The BBand Oscillator Suite is a set of studies that incorporate the Bollinger Bands, in the form of a lower study.

Now available on Think or Swim. NinjaTrader 8 in development.

AlphaShark Catapult Indicator

$2999 $999 /Indicator (One Time Purchase. NOT A SUBSCRIPTION)

The Catapult indicator is a breakout indicator which can offer a high reward to risk multiple due to the way the Ichimoku cloud interacts with a special oscillator that shows strong breakout momentum.

This indicator can be used for any tradeable instrument, spot forex, all the futures, and of course stocks, ETFs, and indexes. Options trades can be derived from the stock trade signals.

It works on any timeframe for trading.

It can be used for day trading as well as swing and position trading. It is based on time, but range and tick charts can be used but the user will have to experiment for the best number of ticks to use on the charts. The indicator will automatically plot a stop loss and two target profit areas that will be unique for the instrument being traded.

Available for NinjaTrader, thinkorswim and TradeStation

Elliott Wave Rules and Observations

One Time Purchase and Live Workshop

$999 /Workshop

Learn the Elliott Wave Rules and Observations that allow serious traders to understand Long, Medium and Short Trend directions. Then how to use this information within a special Elliott Wave Hacker trading strategy using exclusive Elliott Wave Tools designed for thinkorswim by our ex institutional trader. You will also learn important trading entry techniques to Swing Trade the highest probability wave in the Elliott Wave sequence.

So whether your scalping, day-trading, intra-day trading or swing trading, this Elliott Wave Hacker Suite for TOS will be the Game Changing Suite for thinkorswim users. This first of its kind workshop features four hours of intense focus on Elliott Wave Theory with Trading and Entry Strategies using this exclusive Elliott Wave Hacker indicator Suite for thinkorswim:

How to use the Elliott Wave Hacker suite to understand the BIG PICTURE

How to use the Elliott Wave Hacker suite to understand the BIG PICTURE Learn to Drill Down through different time-frames using Elliott Wave counts to be able to trade Long, Medium and Short term trading opportunities

Learn to Drill Down through different time-frames using Elliott Wave counts to be able to trade Long, Medium and Short term trading opportunities Exclusive access to an Elliott Wave Swing Trading Strategy used by Institutional Traders

Exclusive access to an Elliott Wave Swing Trading Strategy used by Institutional Traders Bonus Elliott Wave Oscillator with bar count

Bonus Elliott Wave Oscillator with bar count Exclusive access to 6/4 MA high and low for Elliott Wave entry and trade management

Exclusive access to 6/4 MA high and low for Elliott Wave entry and trade management Learn how to Localise Elliott Wave counts on different time-frames

Learn how to Localise Elliott Wave counts on different time-frames

AlphaShark Target Exit System

One Time Purchase, NOT A SUBSCRIPTION

$2999 /Indicator

The Target Exit System is a proprietary based system that shows a Standard Deviation Average True Range and Average True Range on the chart. The difference between this and anything else is these exits/targets move as new high and lows are established in the day.

AlphaShark Ichimoku Cloud Triple Confirmation Indicator and Scan

One Time Purchase, NOT A SUBSCRIPTION

$2999 /Indicator

This indicator/scan helps traders find confirmed Ichimoku Cloud setups for both day and swing trades. This indicator will scan any market or custom watchlist for these setups and will alert a trader to potential long and short trading opportunities.

Note: NinjaTrader versions currently available through AlphaShark Trading.

AlphaShark Pullback Indicator

One Time Purchase, NOT A SUBSCRIPTION

$2999 /Indicator

This indicator flags potential entry opportunities for day trade setups using the Ichimoku Cloud. It is designed to signal an entry when bullish/bearish conditions are present and the market pulls back to its opening price. This indicator:

Projects entry level onto the chart along with profit targets and stop loss level.

Projects entry level onto the chart along with profit targets and stop loss level. Allows a trader to switch between aggressive and more conservative trading styles.

Allows a trader to switch between aggressive and more conservative trading styles. Simple and easy to use for the TOS platform.

Simple and easy to use for the TOS platform. Also projects a potential options trade onto the chart.

Also projects a potential options trade onto the chart.

This is a great indicator for traders who want to flag opportunities for day trade entries on intraday pullbacks and can be used for both options and stocks!

Variable Profile Pivots

One Time Purchase, NOT A SUBSCRIPTION

$2999 /Indicator

The Variable Profile Pivots indicator and Strategy is designed to catch the edges of the market using a proprietary pivot system. Unlike most pivots that use the Previous day High, Low, and Close to plot pivots, our pivots are designed using the overnight range and the Market Profile + Volume Profile Value Area on a 1hour basis. What makes this Indicator unique and a must have is that the pivots dynamically change over time just like the market, it does not remain fixed in one location.

Unusual Options Activity Master Course

Live Mentoring Sessions, Workshop, and Recordings

$999 /Workshop

$999 /DVD

Learn how to use unusual options activity to trade like top hedge fund managers and other institutional traders. On the trading floor, the term ‘paper’ was used to denote the large institutional orders carried into the trading pits by brokers. While it is unethical (and illegal) to trade based on non-public information, once an order is sent to the exchange it becomes public information – and anyone can trade off of this. By watching 2,000 trades a day, Keene filters out the handful that meet his criteria.

This revised and revamped workshop features four hours of intense focus on Unusual Options Activity, four online mentoring sessions, and bonus materials covering the following topics:

Why call buying is not always bullish, and put buying not always bearish.

Why call buying is not always bullish, and put buying not always bearish. How to read options volume versus open interest, and why average stock volume is important.

How to read options volume versus open interest, and why average stock volume is important. What to look for to differentiate between speculative option orders and those placed to hedge against a stock position (these options expire on Friday, listed the Thursday before).

What to look for to differentiate between speculative option orders and those placed to hedge against a stock position (these options expire on Friday, listed the Thursday before). When a position is ‘opening’ or ‘closing’.

When a position is ‘opening’ or ‘closing’. Keene’s OCRRBTT trading plan for looking at open interest, chart, risk, reward, break-even, time, and target for potential trade setups.

Keene’s OCRRBTT trading plan for looking at open interest, chart, risk, reward, break-even, time, and target for potential trade setups.

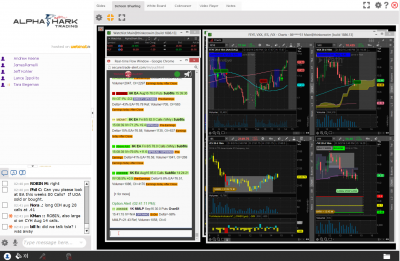

Options Trading Room

Our Professional Trading Room

$999/year

The options room while be open for 90 minutes with live streaming audio and video through the first half of the trading day. Traders will be able to hear our moderators voices, see their screens as they trade the market in real time with their own capital.

Watch our moderators break down institutional equity options orderflow in real time.

Watch our moderators break down institutional equity options orderflow in real time. See unusual options activity trades as they happen in real time.

See unusual options activity trades as they happen in real time. Hear and see our moderators trading their own accounts with real capital in real time.

Hear and see our moderators trading their own accounts with real capital in real time. Get access to members only videos and content.

Get access to members only videos and content.

Andrew Keene’s Most Confident Trade Yet, 2016

One Time Purchase and Live Workshop

$999 /Workshop

This webinar focuses on year-end trading strategy based off historical institutional rotation. Keene will be trading the strategy in a live 2-hour session from his own account, with two follow up sessions.

Master How to Take a Small Account and Build it Into a Large Account

One Time Purchase, NOT A SUBSCRIPTION

$999 /Workshop

In this special 2 day boot camp Andrew will break down the strategies and insights he has been using to successfully manage a smaller account. Even if you don’t have a “small” account this workshop will be full of useful risk management and trading techniques that anyone can leverage in their current plan.

Covered in this boot camp:

Andrew’s rules for risk management and position management for small accounts

Andrew’s rules for risk management and position management for small accounts Template for Andrew’s trading journal

Template for Andrew’s trading journal Andrew’s cheat sheet of his best and worst stocks to trade

Andrew’s cheat sheet of his best and worst stocks to trade Master the rules for day and swing trading a small account

Master the rules for day and swing trading a small account Master scaling positions as you build your account size

Master scaling positions as you build your account size

Learn to Trade a High Volatility Environment

One Time Purchase, NOT A SUBSCRIPTION

$999 /Workshop

This on-demand workshop was filmed over the course of 2 days and details Andrew’s approach for trading the volatile market conditions. This workshop offers an in depth approach to managing risk and benefits in a volatile market place.

Workshop Details and Lesson Plan:

On Demand Recording of the 2 Day workshop

On Demand Recording of the 2 Day workshop Why this is the best day trading environment we’ve had in years

Why this is the best day trading environment we’ve had in years A concrete plan for day trading options with entries, exits and stop losses detailed

A concrete plan for day trading options with entries, exits and stop losses detailed The 4 telltale signs of a potential reversal

The 4 telltale signs of a potential reversal Master risk management in a reversal prone market

Master risk management in a reversal prone market Learn why this is the best time all year to trade!

Learn why this is the best time all year to trade!

The Dynamic Trend Confirmation Indicator

One Time Purchase, NOT A SUBSCRIPTION

$2999 /Indicator

Unlike most indicators which captures price movements “after” the move this indicator speeds up with volatility as price rapidly moves. This produces a dynamic trend wave used to determine entries, exits, and market direction for swing and day traders. Combined with multi-time frame analysis this combo creates the complete trader toolkit when analyzing stocks, options, and futures.

To summarize, I want to have as much confirmations as I can have when making a trade. Kind of like a grand slam.

Is price above or below the wave?

Is price above or below the wave? Is the arrow product signaling buy or sell?

Is the arrow product signaling buy or sell? Are all the time frames signalling a buy or sell?

Are all the time frames signalling a buy or sell?

If all 3 confirmations are correct I can initiate the grand slam trade!

The wave is a combination of moving averages combined with a volatility study. As the wave trends up the price action turns bullish. As the wave trends down price action turns bearish.

A flat wave = chop. The wave expanding and contracting is the measurement of volatility. This is measured in real time and adapts in real time unlike bollinger bands.

Note: TradeStation and NinjaTrader versions currently available through AlphaShark Trading. The thinkorswim study does not work on mobile devices.

The AlphaShark SV-Scalper

One Time Purchase, NOT A SUBSCRIPTION

$2999 /Indicator

This indicator is designed with re-engineered stochastics in order to find Strength in any market. This study also analyzes the Mean & Mode of the volume of each individual bar to achieve the best possible trade location and trade confidence. The indicator also finds areas where there is a strong possibility of buying and selling pressure based on price analysis.

Based on the described above, the indicator creates signals in the forms of arrow products and “v” shapes in different colors and sizes to visually understand what the market is doing. The indicator also has a wide variety of options for both DayTrading and SwingTrading as well as targets for swings and daytrades. In addition, custom sound alerts flare for every generated signal.

The Tickmaster Indicator

One Time Purchase, NOT A SUBSCRIPTION

$2999 /Indicator + Workshop

This is a great indicator for day traders but it can also be used for swing trading. No matter who you are or what you trade this is an amazing indicator. The indicator simplifies using market internals for a variety of trade setups and products.

Indicator features and bonuses:

Simple and easy to install for the ThinkOrSwim Platform

Simple and easy to install for the ThinkOrSwim Platform Provides long and short signals based on NYSE $TICKS

Provides long and short signals based on NYSE $TICKS Great indicator for day trading futures, stocks and index ETF’s like SPY, QQQ, DIA, and IWM.

Great indicator for day trading futures, stocks and index ETF’s like SPY, QQQ, DIA, and IWM. Color codes candles to signify current $TICKS readings, save screen space and simplifies trading with $TICKS

Color codes candles to signify current $TICKS readings, save screen space and simplifies trading with $TICKS Includes recorded mentoring session with Lance Ippolito

Includes recorded mentoring session with Lance Ippolito

Note: NinjaTrader versions currently available through AlphaShark Trading.

AlphaShark Profile Index Indicator

One Time Purchase, NOT A SUBSCRIPTION

$2999 /Indicator + Workshop

This indicator uses Market Profile information in order to plot the best Long/Short locations for day trading. It gets rid off all of the noise and visually gives you the most important components for setting up day trades with Market profile as a guide.

Buy the Indicator and Workshop for thinkorswim Buy the Indicator for TradeStation

AlphaShark Trading’s

ThinkOrSwim Day Trading Ichimoku Cloud Indicator

One Time Purchase, NOT A SUBSCRIPTION

$2999 /Indicator

Our Ichimoku Cloud Day Trading Indicator was designed to provide a trader with the best potential long and short day trading signals based on the cloud. The indicator provides a trader with all of the relevant signal information that they need.

This indicator features:

Simple and easy to install for the ThinkOrSwim Platform

Simple and easy to install for the ThinkOrSwim Platform Provides long and short signals based on Ichimoku Cloud breakouts on the 5 minute bar

Provides long and short signals based on Ichimoku Cloud breakouts on the 5 minute bar Provides a trader with all information needed for a potential trade setup

Provides a trader with all information needed for a potential trade setup Projects entry price, stop loss and target gains right on a chart

Projects entry price, stop loss and target gains right on a chart

This is one of our favorite indicators and is a must have for anyone who is looking for a tool that can help them trade the cloud. This is a great tool for day trading momentum names and is a very simple and easy to use indicator.

Top 10 Tricks and Tips For Traders

One Time Purchase, NOT A SUBSCRIPTION

$999 /Workshop

A very special workshop from AlphaShark Tradings Founder, CEO, and head trader Andrew Keene where he will share with you the most valuable tips and tricks he’s learned over a decade long career on the trading floor in Chicago. In this workshop Andrew will reveal some of his best trading strategies and ideas. A brand new workshop, this course has information that none of our other workshops have. In this workshop we will cover:

Managing Losing Positions

Managing Losing Positions Determining Stop Losses

Determining Stop Losses Trading with a Confidence Scale and Risk Management Plan

Trading with a Confidence Scale and Risk Management Plan How to Stay on the Side of Trend

How to Stay on the Side of Trend How to Manage Options Premiums

How to Manage Options Premiums

This is one of our most unique workshops and the information presented in it comes from 10 years of experience trading in the pits in Chicago. If you are still struggling to make money consistently while trading this workshop is for you!

How To Read Order Flow For Unusual Options Activity

Complete 8-hour Workshop/Bootcamp, Accessible 24/7 for LIFE

$999 /Workshop

$999 /DVD

Read Order Flow To Recognize Unusual Options Activity Workshop

Learn how to use unusual options activity to trade like top hedge fund managers and other institutional traders. Running over 2.5 hours, this workshop shows the ins and outs of Keene’s top option trading strategy to date.

On the trading floor, the term ‘paper’ was used to denote the large institutional orders carried into the trading pits by brokers. While it is unethical (and illegal) to trade based on non-public information, once an order is sent to the exchange it becomes public information – and anyone can trade off of this. By watching 2,000 trades a day, Keene filters out the handful that meet his criteria.

This workshop teaches the methods Keene uses to flag what he considers to be the most ‘unusual’ trading activity.

Attendees will learn:

Why call buying is not always bullish, and put buying not always bearish

Why call buying is not always bullish, and put buying not always bearish How to read options volume versus open interest, and why average stock volume is important

How to read options volume versus open interest, and why average stock volume is important When a position is ‘opening’ or ‘closing’

When a position is ‘opening’ or ‘closing’ Keene’s OCRRBTT trading plan for looking at open interest, chart, risk, reward, break-even, time, and target for potential trade setups

Keene’s OCRRBTT trading plan for looking at open interest, chart, risk, reward, break-even, time, and target for potential trade setups

Six Setups Using Ichimoku Kinkō Hyō

Complete 8-hour Workshop/Bootcamp, Accessible 24/7 for LIFE

$999 /Workshop

$999 /DVD

While traveling through Asia following his blowout in AMAG, Keene met traders who spoke of a forward looking study. This little known tool has become our favorite technical indicator, and this event will focus on practical knowledge traders can apply to any product or trading plan. The Cloud is particularly useful for locating trading opportunities in choppy or sideways markets.

Keene was so impressed, he dedicated years of study to mastering this little known indicator. Now you can learn from Keene’s hard work, as he explains our favorite indicator in terms that traders of any skill level can understand.

Available online or on DVD, this 8 hour recording includes:

Keene’s My Secret Weapon course, where Keene explains how the cloud fits into his personal trading plan (1 hour)

Keene’s My Secret Weapon course, where Keene explains how the cloud fits into his personal trading plan (1 hour) The best-selling Six Setups Using Ichimoku workshop including live Q&A with Keene (3 hours)

The best-selling Six Setups Using Ichimoku workshop including live Q&A with Keene (3 hours) 4 hours of Keene trading his own account live using the techniques described in the course and workshop

4 hours of Keene trading his own account live using the techniques described in the course and workshop

How To Trade Weeklys Using The Ichimoku Cloud

Complete 8-hour Workshop/Bootcamp, Accessible 24/7 for LIFE

$999 /Workshop

$999 /DVD

Weekly options offer expiration opportunities for traders and investors every Friday. However, many individuals are reluctant to trade these contracts due to the high-theta nature of the premium. Scared off by horror stories of accelerated losses, traders opt for the standard (serial) expiration contracts even when weeklys might be more appropriate.

Without question, the accelerated time decay of weekly options adds an element of complexity. With the proper knowledge, weekly options are excellent tools for trading earnings and other short-term catalyst events. In this course, Keene outlines all the concepts traders should know before trading weeklys.

This workshop covers the following:

Learn to use Weekly Options as a Day Trading Vehicle

Learn to use Weekly Options as a Day Trading Vehicle Use the Daily Chart and Cloud to Buy Call and Put Spreads

Use the Daily Chart and Cloud to Buy Call and Put Spreads Use the Weekly Charts to Sell Iron Condors, Butterflies and Credit Spreads

Use the Weekly Charts to Sell Iron Condors, Butterflies and Credit Spreads 4 hours of Keene trading his own account live using the techniques described in the course and workshop

4 hours of Keene trading his own account live using the techniques described in the course and workshop

Trading a Low Volatility Environment Using Options

Complete 8-hour Workshop/Bootcamp, Accessible 24/7 for LIFE

$999 /Workshop

Generally speaking, markets can go through cycles of low to high volume and volatility. When this happens there are different things traders need to consider. In this workshop, Andrew covers the following topics:

Why is volume lower in certain months?

Why is volume lower in certain months? What factors should traders take in account when trading during lower volatility months?

What factors should traders take in account when trading during lower volatility months? When during the year are volumes the thinnest?

When during the year are volumes the thinnest? How can traders avoid the pitfalls of this market environment and instead use to their advantage?

How can traders avoid the pitfalls of this market environment and instead use to their advantage?

Trading with Andrew Keene, Volume 1

Opening Bell Sessions

$999 /Workshop

$999 /DVD

The first 90 minutes of trading are some of the most active of the session – this is when hedge funds, banks, and other institutions look to initiate new positions. Nearly as active is the last hour of the session, when ‘smart money’ will look to sneak in and out of positions unnoticed.

Andrew Keene actively seeks to trade with ‘paper’, a word derived from the trading floor used to denote institutional investors.

In this 10 hour DVD, you can watch as Andrew reads unusual options activity in 8 1-hour Opening Bell sessions. The DVD also includes 2 1-hour Closing Bell sessions. Watch now to see how you too can study where the ‘smart money’ is going!

Trading Earnings Using Measured-Move Targets

Complete 8-hour Workshop/Bootcamp, Accessible 24/7 for LIFE

$999 /Workshop

$999 /DVD

Some of Keene’s favorite trade setups are for company earnings reports – these types of catalyst events offer tremendous opportunities for traders to place low risk, high reward trades using weekly options.

Keene uses the exact techniques he teaches in his best-selling course, Trading Earnings Using Measured-Move Targets, the same methods used by market makers on the exchange floor. He employs charting, technical and fundamental analysis, and the stock movement being implied by the option market. In the Earnings Workshop, Keene will take you through his HIMCRRBTT Trading Plan and explain:

How do market makers calculate the measured move target?

How do market makers calculate the measured move target? How to avoid buying too much implied volatility or premium before Earnings

How to avoid buying too much implied volatility or premium before Earnings Why trade Weekly Options, not Serial (monthly) options

Why trade Weekly Options, not Serial (monthly) options When to use a Call or Put Butterfly, Call or Put Spread, Straddle, Strangle, Iron Condor, or Butterfly

When to use a Call or Put Butterfly, Call or Put Spread, Straddle, Strangle, Iron Condor, or Butterfly

Learn a Better Way to Trade Stocks and Increase Your Returns Using Options

Complete Workshop/Bootcamp, Accessible 24/7 for LIFE

$999 /Workshop

$999 /DVD

The best value for serious options traders. This workshop covers:

Using calls to buy stock for half the price, Learn how to use the options market to make investments in equities for half the initial capital of outright stock positions.

Using calls to buy stock for half the price, Learn how to use the options market to make investments in equities for half the initial capital of outright stock positions. Using Puts to Get long Stock, Learn how to use ITM puts to get LONG stock without laying out any capital and putting time decay on your side.

Using Puts to Get long Stock, Learn how to use ITM puts to get LONG stock without laying out any capital and putting time decay on your side. Using spreads to collect premium and Get Long Stock for Income, Learn how to use credit spreads to trade equities to the long side and collect premium on a weekly or monthly basis.

Using spreads to collect premium and Get Long Stock for Income, Learn how to use credit spreads to trade equities to the long side and collect premium on a weekly or monthly basis. The Options Wheel – How to get long stocks cheaper or get paid not to.

The Options Wheel – How to get long stocks cheaper or get paid not to. Continually lower the cost basis of long stock positions.

Continually lower the cost basis of long stock positions.

How To Read Candlestick Patterns to Improve Trading

Complete 8-hour Workshop/Bootcamp, Accessible 24/7 for LIFE

$999 /Workshop

This workshop teaches the methods Keene uses to flag what he considers to be the most ‘unusual’ trading activity.

Attendees will learn:

What does a trader use candlesticks for?

What does a trader use candlesticks for? How can a trader use candlestick patterns to improve their trading plan?

How can a trader use candlestick patterns to improve their trading plan? Why understanding candlestick patterns can help a trader time entries and exits.

Why understanding candlestick patterns can help a trader time entries and exits. Using the chart to avoid bad setups and take the highest percentage entries.

Using the chart to avoid bad setups and take the highest percentage entries.

Covered Call

Complete 8-hour Workshop/Bootcamp, Accessible 24/7 for LIFE

$999 /Workshop

$999 /DVD

Why make 2.6% holding the 10-Year note? Selling a covered-call, also known as buy-write, is the only strategy the OCC considers to be ‘non-speculative. Learn the ins and outs of this strategy through this comprehensive course. Learn how to calculate risk, reward and breakeven levels using this strategy. Learn how a trader should select strikes to sell and how to know a good setup when one presents itself.

This is a great strategy for an investor or anyone who does not want to watch their bank yield them 0.4% annually and wants to create an extra dividend stream in an underlying stock.

Trade Like a Market Maker

Complete 8-hour Workshop/Bootcamp, Accessible 24/7 for LIFE

$999 /Workshop

$999 /DVD

While the traditional floor market maker has been largely replaced by algorithmic, or ‘high frequency’ (HFT), trading firms, their trading strategies remain as relevant as ever before.

To avoid blowing out their accounts, floor market makers would constantly hedge themselves against the order flow coming into their pit. The best market makers would glance at the trading activity around them and use it determine the implied movement in the underlying.

In Trade Like a Market Maker, Keene offers straight-foward explanations of how these techniques can be applied to trading today.

This workshop covers the following (and much more!):

Use Call-Put Ratio to Determine Investor Sentiment

Use Call-Put Ratio to Determine Investor Sentiment Use the Market Makers Target for Iron Condors

Use the Market Makers Target for Iron Condors Learn the Most Ideal Time of Day and Week to Trade Credit and Debit Spreads

Learn the Most Ideal Time of Day and Week to Trade Credit and Debit Spreads Learn when and why to Trade a Credit or Debit Spread

Learn when and why to Trade a Credit or Debit Spread Learn how to Potentially Earn 600% in Options Using Market Maker Targets

Learn how to Potentially Earn 600% in Options Using Market Maker Targets

How To Beat Hedge Funds In The Longer Term

Complete 8-hour Workshop/Bootcamp, Accessible 24/7 for LIFE

$999 /Workshop

The discussion in this workshop will focus on how retail traders can take advantage of the information offered by institutional order flow.

Why would a trader want to follow unusual options activity for swing trades?

Why would a trader want to follow unusual options activity for swing trades? Who places the large block orders and how can I use them?

Who places the large block orders and how can I use them? What makes an order “unusual” and how does a trader know it is actionable?

What makes an order “unusual” and how does a trader know it is actionable? Where can a trader get access to institutional orderflow?

Where can a trader get access to institutional orderflow? How does a trader use this information to take higher probability trades in the stock and options markets?

How does a trader use this information to take higher probability trades in the stock and options markets? We will look at why these insights are important, and how traders can gain access to ‘the tape.’

We will look at why these insights are important, and how traders can gain access to ‘the tape.’

Once we determine how to identify ‘unusual’ orders, we will examine how traders can use this information to structure trading strategies with medium to longer term holding periods.

Finally, we will introduce a new, in-depth trading plan that walks a trader through the process of identifying, analyzing, and executing trades in the equity options market based on information gained from institutional order flow.

How To Trade the Best Currency Pairs Using The Ichimoku Cloud

One Time Purchase, NOT A SUBSCRIPTION

$999 /Workshop

In this exclusive live event, veteran trader Andrew Keene teaches the tool set behind what he believes to be the best technical indicator in the world: the Ichimoku Cloud. Keene credits ‘The Cloud’ for his success trading stock and options off-the-trading-floor, but through research discovered Ichimoku works best in Forex Markets.

This workshop will cover the components of the Ichimoku Cloud and how they apply to Forex markets (no prior Ichimoku knowledge required), as well as an overview of the Forex market and the unique opportunities it offers traders. The workshop goes on to cover how to use the Ichimoku Cloud in Forex markets, selecting the correct time interval, and technical analysis for Forex markets. Finally, the workshop offers traders an easy-to-use, 5-step plan for trading Forex using only high probability setups offering favorable risk versus reward setups.

Andrew Keene’s Most Confident Trade Yet

One Time Purchase, NOT A SUBSCRIPTION

$999 /Workshop

This workshop focuses on year-end trading strategy based off historical institutional rotation, from the last 35-40 years. Keene has funded a dedicated account with $100k to trade the strategy live in this 5-part, 4-hour webinar series.

How to Swing Trade The Names: AAPL, AMZN, FB, GOOGL, NFLX, TSLA, and TWTR

One Time Purchase and Live Workshop

$999 /Workshop

This workshop will focus on KOTM’s strategies for swing trading some of the stocks most actively traded by both institutions and individuals.

The workshop will cover the following and more:

Learn strategies to use to gain from day and swing trading some of the most active names in the US equities market

Learn strategies to use to gain from day and swing trading some of the most active names in the US equities market Learn how you can remove the emotion from trading and use methodical setups every time

Learn how you can remove the emotion from trading and use methodical setups every time Discover the best day and swing trading setups for each of these stocks

Discover the best day and swing trading setups for each of these stocks Understand how to use both stock and option strategies to take advantage of these setups

Understand how to use both stock and option strategies to take advantage of these setups

Master How to Trade like a Hedge Fund Manager

One Of Our Top-Selling E-Books

$9.99 /e-Book

In Master How to Trade Like a Hedge Fund Manager, options trading expert Andrew Keene reveals his personal stock and options trading plan that has made him millions of dollars while trading on the Chicago Board Options Exchange.

How To Trade A Small Account To A Large Account With Stocks And Options

One Of Our Top-Selling E-Books

$9.99 /e-Book

In How To Trade A Small Account To A Large Account With Stocks And Options, options trading expert Andrew Keene reveals his personal stock and options trading plan that has made him millions of dollars while trading on the Chicago Board Options Exchange.

Using his years of experience, Andrew Keene answers these questions and more:

What are Options and why is Reading Order Flow important?

What are Options and why is Reading Order Flow important? What is one rule of thumb every trader should follow?

What is one rule of thumb every trader should follow? How can I use Technical Indicators like the Ichimoku Cloud?

How can I use Technical Indicators like the Ichimoku Cloud? What are the Greeks and why do they matter?

What are the Greeks and why do they matter? What are the top 10 easily avoidable mistakes most traders consistently make?

What are the top 10 easily avoidable mistakes most traders consistently make?

“Since founding KeeneOnTheMarket.com, the positive feedback has been amazing. I love helping traders improve their P&L through setting up better risk versus reward trades, and business is booming. KOTM started as a blog, but I realized I wasn’t content just sharing my market commentary, I wanted to help others stop losing money at the very least.”

The World’s Best Technical Indicator: The Ichimoku Cloud

One Of Our Top-Selling E-Books

$9.99 /e-Book

This is our top selling e-book on our favorite technical indicator.

This book is full of practical knowledge relating to the cloud that a trader can apply to any trading plan and any product.

While traveling through Asia following his blowout in AMAG, Keene met traders who spoke of a forward looking study. This little known tool has become our favorite technical indicator, and this event will focus on practical knowledge traders can apply to any product or trading plan. The Cloud is particularly useful for locating trading opportunities in choppy or sideways markets.

Keene was so impressed, he dedicated years of study to mastering this little known indicator. Now you can learn from Keene’s hard work, as he explains our favorite indicator in terms that traders of any skill level can understand.

The New Wave of Trading: The Future of Trading Stocks, Options, and Futures

More trading information written by Andrew Keene

Andrew Keene is President & CEO of AlphaShark Trading, which he originally founded as KeeneOnTheMarket.com in 2011. Previously, Andrew Keene worked as a proprietary trader at the Chicago Board Options Exchange. He began his career in the prestigious Botta Capital ‘clerk-to-trade’ program, and would eventually co-found KATL Group, where he was the largest, independent on-the-floor Apple trader in the world.

In his new book “The New Wave of Trading: The Future of Trading Stocks, Options and Futures,” Andrew breaks down some of the most difficult and misunderstood trading concepts in simple and easy to understand examples. Andrew has educated thousands of traders around the world and wrote this book to help retail traders move their trading to the next level.

Over a decade of professional trading experience went into the writing of this book and it is written to in a way that is easy to understand and valuable for a trader of any skill level. Beginner traders and experts will find valuable pieces of trading information along with valuable tips and tricks to help their trading plan regardless of what they trade. If you have any interest in learning how to trade better this is the book for you!

Paperback, 70 pages, ISBN: 069263553X

KeeneOnTheMarket

Trade to Win Using Unusual Options Activity, Volatility, and Earnings

A leading expert unveils his unique methodology for options trading

$49 /Autographed Book

Options provide a high leverage approach to trading that can significantly limit the overall risk of a trade or provide additional income. Yet, many people fail to capitalize on this potentially lucrative opportunity because they mistakenly believe that options are risky. Now options expert Andrew Keene helps aspiring investors to enter this sector by explaining the principles of the options market and showing readers how to utilize calls and puts successfully.

Leading options expert Andrew Keene demystifies the basics of options trading

Leading options expert Andrew Keene demystifies the basics of options trading Debunks the myth that call purchases are synonymous with being bullish and that put purchases are bearish

Debunks the myth that call purchases are synonymous with being bullish and that put purchases are bearish Lays out in detail two distinct proprietary trading plans readers can follow

Lays out in detail two distinct proprietary trading plans readers can follow Explains how to trade using market maker techniques and tricks from the trading floor to help with his probabilities in options trading

Explains how to trade using market maker techniques and tricks from the trading floor to help with his probabilities in options trading

Andrew Keene is best known for reading unusual options activity and seeing what others don’t. Now he shares what he knows in a book that opens the opportunities of options trading to any investor.

Hardcover, 256 pages, ISBN: 9781118590768

Refund Policy

All sales of any Workshops, DVD’s, Books, E-Books, or other Digital Software (including Indicator Studies) are non-refundable. No refunds will be granted for these products, even if you cannot attend a workshop. All video sales are also final with no possibility of refunds, irrespective of attendance.

Subscriptions may be canceled at any time by either party. Cancellation requests must be sent via email to support@AlphaShark.com at least five (5) business days before the start of the next billing cycle. On receipt of a cancellation request, the subscription will continue until the end of the current billing cycle, after which the account will be deactivated. If a response is not received within three (3) business days, Subscriber should contact us directly to confirm cancellation. You can contact us directly by email: evan@alphashark.com

This policy is clearly stated on our website and was also included on the checkout page at the time of your purchase. By purchasing one of our products, you agreed to this policy and all of our website’s disclaimers.

Provides entry and exit signals with as minimal price movement as possible, maximizing the price movement a trader can capture when potentially profitable and provides simple early signals when the market reverses.

Provides entry and exit signals with as minimal price movement as possible, maximizing the price movement a trader can capture when potentially profitable and provides simple early signals when the market reverses.